Brought to you by:

Enterprise Strategy Group | Getting to the Bigger Truth™

ESG RESEARCH INSIGHTS PAPER

Understanding the Benefits of Cloud Operations for Dedicated Infrastructure

Measuring the Desire for, Progress Toward, and Pay-off of aaS for Dedicated Infrastructure

By Adam DeMattia, Research Director; Michael Barry, Market Research Analyst, Custom Research; and Scott Sinclair, Senior Analyst

AUGUST 2021

Executive Summary

Figure 1. Perceptions Related to Cloud Computing and Modern IT

Please rate your level of agreement with the following statements? (Percent of respondents, N=1,000)

Source: Enterprise Strategy Group

Segmenting Organizations by Their Adoption of aaS for Dedicated Infrastructure

Figure 2. Organizations’ Preferences for IT Operations

Thinking of the IT operations associated with dedicated infrastructure, for each row below, please indicate what your organization would prefer? (Percent of respondents, N=1,000)

Source: Enterprise Strategy Group

Figure 3. Organizations’ Progress Toward Adopting Cloud Operations for Dedicated Infrastructure

Source: Enterprise Strategy Group

Research Findings

How aaS Adoption Improves IT Operations

Figure 4. Benefits Achieved in Dedicated Infrastructure Environments

Have you seen any of the following benefits in your organization’s dedicated IT infrastructure environment over the last 12 months? (Percent of respondents, "Yes" responses only)

Source: Enterprise Strategy Group

Efficiency Breeds Agility for Leading Organizations

Leading Organizations Achieve Greater Infrastructure Reliability

Figure 5. Frequency of Service-impacting Events in Dedicated Infrastructure Environments

How often does your organization encounter a service-impacting event in its dedicated infrastructure (i.e., an event which causes an IT service or application to be noticeably degraded or unavailable)? (Percent of respondents)

Source: Enterprise Strategy Group

Figure 6. Time to Remediate Service-impacting Events in Dedicated Infrastructure Environments

Generally speaking, how much time goes by from the time a root cause of a serviceimpacting event affecting dedicated infrastructure and workloads is found, and a fix can be deployed? (Percent of respondents)

Source: Enterprise Strategy Group

Agile and Reliable IT Delights End-users

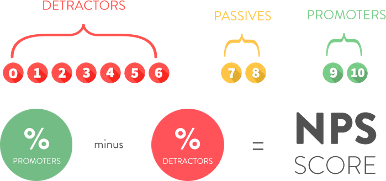

Figure 7. End-user Satisfaction by Level of aaS Adoption

Source: Enterprise Strategy Group

| Level of aaS adoption | Percentage with end-users that are promoters | Percentage with end-users that are detractors | NPS |

|---|---|---|---|

| Leading | 55% | 2% | +53 |

| Fast Following | 31% | 13% | +18 |

| Late Majority | 39% | 22% | +27 |

| Lagging | 28% | 20% | +8 |

How aaS Adoption Supports Business Outcomes

aaS Agility Helps Organizations Outpace Competitors and Transform

Figure 8. Time-to-market Performance of Organizations

Considering your last few major product launches/releases, how has your organization compared to competitors (e.g., have you been ahead or behind the competition)? (Percent of respondents)

Source: Enterprise Strategy Group

The Resiliency Associated with aaS Adoption Helps Organizations Perform, Even in Trying Times

98% of Leading organizations say their IT resiliency helped avoid product release delays and lost productivity over the last 12 months.

Businesses Recognize the Value of IT at aaS Adopters

Figure 9. View of the IT Organization by the C-suite

How does your organization’s C-suite business executives view the IT organization? (Percent of respondents)

Source: Enterprise Strategy Group

The Financial Implications of aaS Adoption

Figure 10. IT Infrastructure Cost Savings by aaS Adoption

By how much do you believe your organization has reduced IT infrastructure costs over the last 12 months? (Percent of respondents, N=1,000)

Source: Enterprise Strategy Group

The Bigger Truth

Figure 11. Organizations’ Financial Performance by aaS Adoption

Thinking about your company’s current fiscal year (FY), which of the following represents your company’s performance (or expected performance) relative to its revenue goal? (Percent of respondents)

Source: Enterprise Strategy Group

RESPONDENT METHODOLOGY AND DEMOGRAPHICS

To gather data for this report, ESG conducted a comprehensive survey of IT professionals currently knowledgeable about their organization’s long-term cloud strategy and influential in their cloud and infrastructure purchasing. Organizations represented spanned the globe, including North America (Canada, US; 40%), Europe (UK, Germany; 26%), the Nordics (Denmark, Norway, Sweden; 5%), and APJC (Japan, Singapore, Hong Kong, Australia, New Zealand; 31%). Organizations represented are enterprises with 1,000+ employees. The survey was fielded between March 16, 2021 and March 29, 2021. All respondents were provided an incentive to complete the survey in the form of cash awards and/or cash equivalents.

After filtering out unqualified respondents, removing duplicate responses, and screening the remaining completed responses (on several criteria) for data integrity, a final sample of 1,000 respondents remained. The figures that follow detail the demographics of the respondent base. Note: Totals in figures and tables throughout this report may not add up to 100% due to rounding.

Figure 12. Respondent’s Responsibility Level

Which of the following best describes your current job title/level?(Percent of respondents, N=1,000)

Source: Enterprise Strategy Group

Figure 13. Respondents by Company Size (Number of Employees)

How many total employees does your company have worldwide?(Percent of respondents, N=1,000)

Source: Enterprise Strategy Group

Figure 14. Respondents by Company Size (Annual Revenue)

What is your company’s total annual revenue ($US)? (Percent of respondents, N=1,000)

Source: Enterprise Strategy Group

Figure 15. Respondents by Industry

What is your organization’s primary industry? (Percent of respondents, N=1,000)

Source: Enterprise Strategy Group

This ESG Research Insights Paper was commissioned by Dell Technologies and is distributed under license from ESG.

All trademark names are property of their respective companies. Information contained in this publication has been obtained by sources The Enterprise Strategy Group (ESG) considers to be reliable but is not warranted by ESG. This publication may contain opinions of ESG, which are subject to change from time to time. This publication is copyrighted by The Enterprise Strategy Group, Inc. Any reproduction or redistribution of this publication, in whole or in part, whether in hard-copy format, electronically, or otherwise to persons not authorized to receive it, without the express consent of The Enterprise Strategy Group, Inc., is in violation of U.S. copyright law and will be subject to an action for civil damages and, if applicable, criminal prosecution. Should you have any questions, please contact ESG Client Relations at 508.482.0188.

Enterprise Strategy Group | Getting to the Bigger Truth™

Enterprise Strategy Group is an IT analyst, research, validation, and strategy firm that provides market intelligence and actionable insight to the global IT community.